osceola county property tax rate

Where to go for State Tax Help. If the tax rate is 1 the Petersons will owe 2000 in property tax.

Osceola County Ordinance 00 13 Indian Wells Hoa

To access specific property tax programs services and information please use the Property Tax Services menu available on this page.

. Homeowners in Pinellas County pay a median property tax of 1642 per year. Florida authorities compute your property tax by multiplying your homes taxable value by the applicable tax rate. The average effective property tax rate in Macomb County is 168.

Osceola County Tax Collectors Office Birth Certificates Only Osceola County Tax Collectors Office Kissimmee Office 2501 E. In Sterling Heights the most populous city in the county mill rates on principal residences range from 3606 mills to 4313 mills. Gauging your property tax amount is.

The average effective tax rate in Pinellas County is 090. Real property refers to land buildings fixtures and all other improvements to the land. The median property tax in Osceola County Florida is 1887 per year for a home worth the median value of 199200.

Osceola County Tax Collectors Office St Cloud Office Birth Certificates Only 1300 9th Street Suite 101B St. Osceola County Value Adjustment Board Local governments raise funds each year by collecting taxes on real and tangible property located in each governments jurisdiction. This largely suburban county northeast of Detroit has property tax rates that rank fairly high nationally.

Florida property tax due dates depend on the county within Florida. These taxes are known as ad valorem or property taxes and are calculated by multiplying the millage rate times the value of the property owned by the tax payer. Cloud FL 34769 Phone.

What is the Florida Property Tax Rate. Property taxes can be confusing. The median property tax in Cook County Illinois is 3681 per year for a home worth the median value of 265800.

Osceola County has one of the highest median property taxes in the United States and is ranked 516th of the 3143 counties in order of median property taxes. Ad valorem taxes are. Tax rates in the county are likewise relatively low.

If you can reduce the taxable value of your home your. Thats less than the state average and much less than the national average. Cook County has one of the highest median property taxes in the United States and is ranked 91st of the 3143 counties in order of median property taxes.

Osceola County collects on average 095 of a propertys assessed fair market value as property tax. Irlo Bronson Memorial Hwy Kissimmee FL 34744 Phone. Jackie Russell 500 W 4th St Room 107 Hastings NE 68901 402-461-7116.

Property taxes are levied annually on real property real estate and tangible personal property. Cook County collects on average 138 of a propertys assessed fair market value as property tax. For example imagine that the tax appraiser has placed a taxable value of 200000 on the Petersons home.

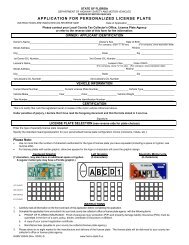

Ayment Ptions Osceola County Tax Collector

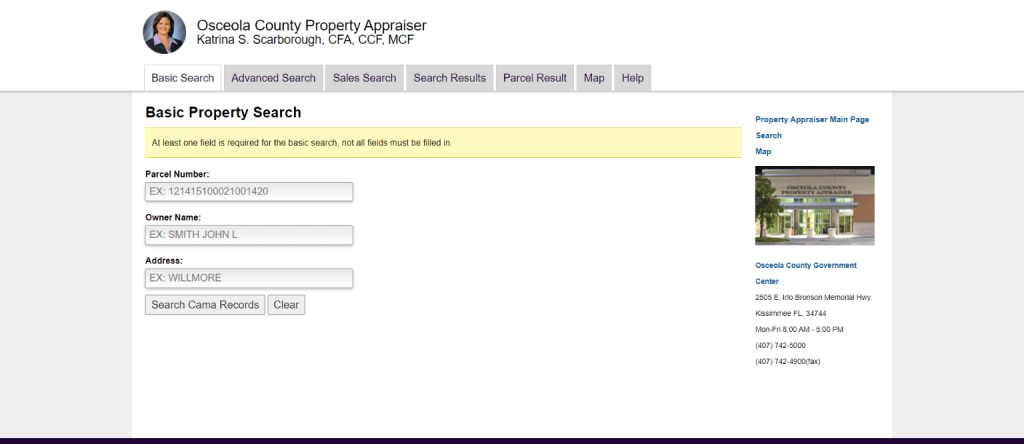

Osceola County Property Appraiser How To Check Your Property S Value

Property Tax Search Taxsys Osceola County Tax Collector

![]()

Osceola County St Cloud Propose Smaller 2021 22 Budgets Osceola News Gazette

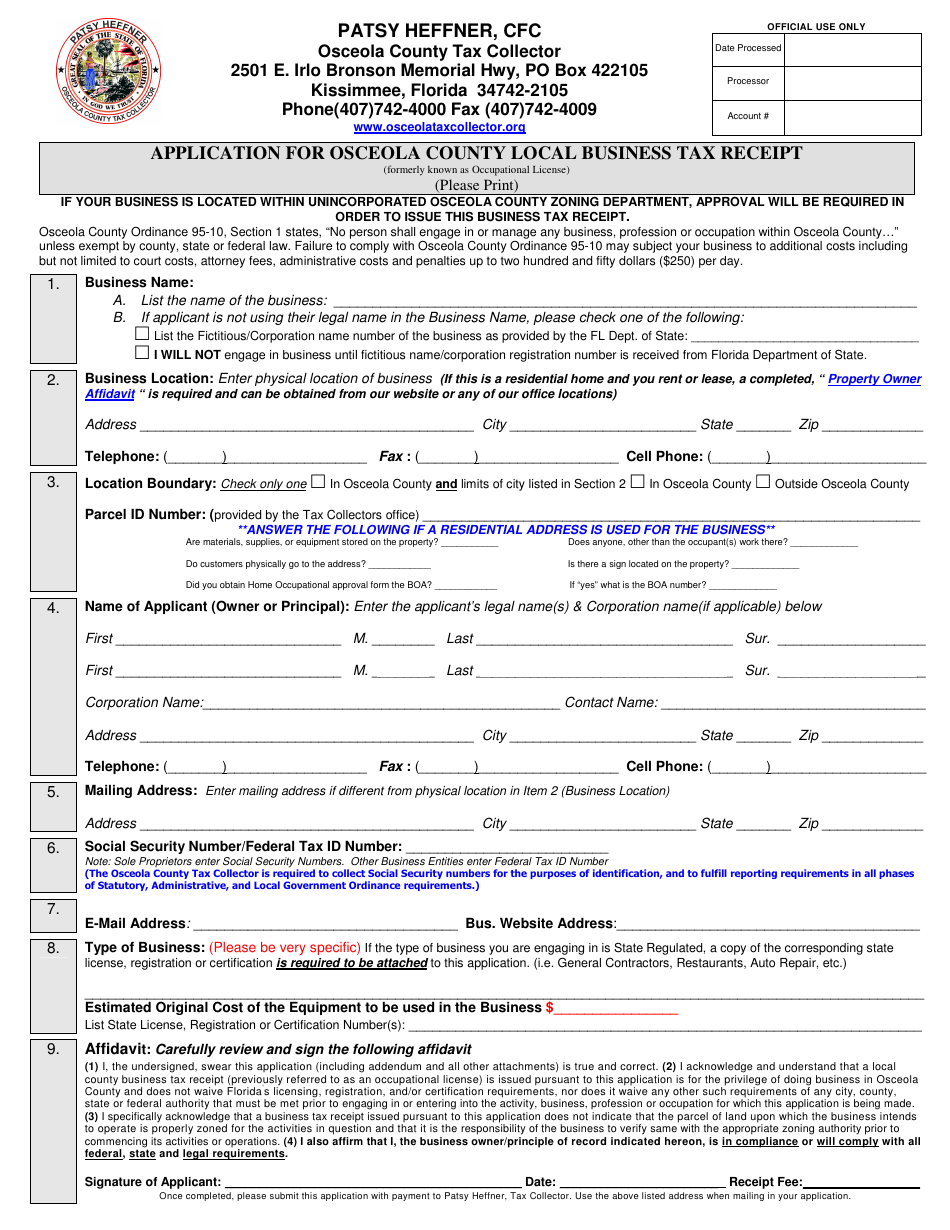

Osceola County Florida Application For Osceola County Local Business Tax Receipt Form Download Fillable Pdf Templateroller

David Weekly Townhouse Home Owners Association Fees In Spring Lake Celebration Fl Spring Lake Lake Garden Celebration Fl

Osceola County Fl Property Tax Search And Records Propertyshark

Osceola County Property Appraiser How To Check Your Property S Value

Osceola County Florida Application For Osceola County Local Business Tax Receipt Form Download Fillable Pdf Templateroller

Osceola County Property Appraiser How To Check Your Property S Value

Osceola County Property Appraiser Katrina S Scarborough Cfa Ccf Mcf Facebook

David Weekly Townhouse Home Owners Association Fees In Spring Lake Celebration Fl Spring Lake Lake Garden Celebration Fl

Ayment Ptions Osceola County Tax Collector

Osceola County Fl Property Tax Search And Records Propertyshark